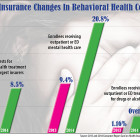

Access Health Special Enrollment Period Extended To Oct. 31

|

The state has extended the deadline to apply for health insurance plans through the American Rescue Plan Act Special Enrollment Period to October 31. Also, as of July 1, some Connecticut residents that meet specific eligibility requirements can pay $0 for their health insurance coverage through Access Health CT, thanks to the new Covered Connecticut Program created by the state. To qualify for the Covered Connecticut Program, you must:

Have a household annual income that is greater than 160%, and up to

and including 175% of the federal poverty level. Have at least one dependent child in the household under age 19; children age 18 must be a full-time student in secondary school. Be eligible for advance premium tax credits (APTCs) and cost-sharing

reductions (CSRs).