I-Team In-Depth

Report: Private Insurers Deny More Claims For Mental Health Care

|

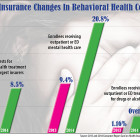

The rate of denials by the state’s largest managed care insurers of requests for mental health services rose nearly 70 percent between 2013 and 2014, with an average of about one in 12 requests for prescribed treatment initially rejected, a new state report shows. At the same time, the proportion of enrollees in the largest managed care companies who received outpatient or emergency department care for mental health doubled, from an average of 9.4 percent in 2013 to 20.8 percent in 2014, according to an analysis of the 2015 Consumer Report Card on Health Insurance Carriers in Connecticut, issued by the state Insurance Department. The percentage of members who received inpatient mental health care also doubled, although it remained low, with most companies providing inpatient services for less than .5 percent of all enrollees. The rise in rejections by the state’s 10 largest indemnity managed care companies – private health insurers, not including Medicare or Medicaid — came as state officials focused on improving mental health outreach and treatment, in the wake of the Sandy Hook school shooting in December 2012. The managed care organizations include companies such as Aetna Life Insurance Co., Anthem Health Plans, CIGNA Health and Life Insurance Co., and UnitedHealthcare Insurance Co.