As the state readies for open enrollment for health insurance beginning November 1, those who have lost their jobs or have recently moved to Connecticut can get coverage now through Access Health CT (AHCT).

For those who don’t have a qualifying event for special enrollment—such as getting married, giving birth or adopting a child—open enrollment for 2021 health insurance plans begins Nov. 1 and runs through Dec. 15.

Consumers can begin “window shopping” and comparing plans on Oct. 26 but can’t enroll or re-enroll in coverage until Nov. 1. Open enrollment is for coverage that begins Jan. 1.

As job cuts continue to mount in the state amid the COVID-19 pandemic, anyone who loses employer-backed insurance coverage qualifies for special enrollment and has 60 days from the time of their job loss to enroll in a plan offered through the marketplace.

“If 2020 has taught us anything, it’s that having and keeping and using health insurance is incredibly important,” said Andrea Ravitz, AHCT’s marketing director. AHCT is closely monitoring reports of layoffs and contacting affected workers as quickly as possible, she said.

“A lot of individuals don’t know that we even exist,” Ravitz said. She said many workers have long held insurance policies through their employers and haven’t needed to secure coverage on their own until now.

To reach a licensed broker to discuss health insurance options call 855-805-4325.

This will be the eighth open enrollment for AHCT, which is the insurance marketplace created by the Affordable Care Act.

For 2021, the exchange will again offer plans from Anthem and ConnectiCare. Earlier this fall, the state Insurance Department reduced the rate increases each company sought. The average rate increase for Anthem plans will be 1.9%, while ConnectiCare customers will see an average rate decrease of 0.1%.

But consumers should not choose plans based solely on premium price tags, Ravitz said.

“Even if you’re experiencing a decrease in your rate, it doesn’t mean that you’re in the right plan,” she said. The “Compare Plans” tool at accesshealthct.com lets consumers view plans while considering their specific doctors, prescription drugs costs and medical habits, giving them a clearer picture of how much each plan will cost them out of pocket.

Currently, nearly 100,000 people are enrolled in qualified health plans through AHCT, up about 5% from a year ago, and about 700,000 are enrolled in Medicaid plans through the exchange, up roughly 10% from a year ago, according to Ravitz.

In the early days of the pandemic, the state and AHCT announced in March a new special enrollment period during which anyone uninsured could enroll in coverage. That period ran from March 19 through April 2 for coverage that began April 1. Around that time—between March 19 and April 17—5,629 people enrolled in qualified health plans and 26,773 individuals enrolled in Medicaid or Children’s Health Insurance Plan (CHIP), according to AHCT.

More than 90% of people who purchased plans through the exchange qualify for financial help or price reductions, she said.

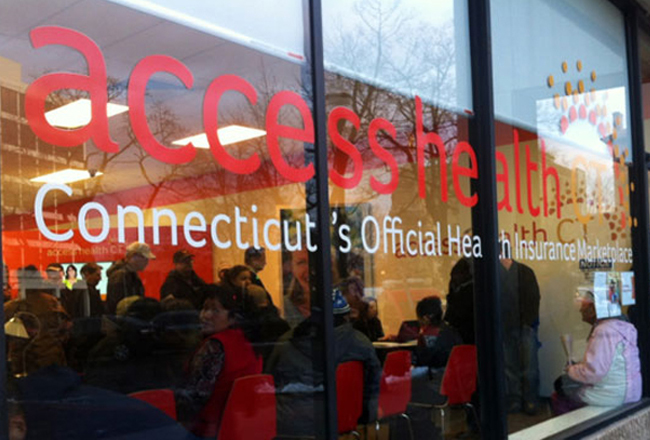

As usual, AHCT will offer consumers multiple ways to connect with licensed brokers who can help them understand plan options: online at accesshealthct.com, by phone at 855-805-4325 and in person.

Six enrollment centers will be open for in-person appointments. Reservations will be required at the sites, which will follow strict COVID safety guidelines, and walk-ins will not be allowed. Individuals who schedule appointments will be contacted by AHCT before their appointment to ensure they have all necessary documents and information they will need to complete their enrollment at their meeting, Ravitz said.

Enrollment centers will be located at Project Access, 63 York St., New Haven; and Community Renewal Team, 330 Market St., Hartford. Others will be in Bridgeport, Stamford, New Britain and Groton.

AHCT also will hold multiple virtual enrollment fairs this year. During those events, if enrollees want, customer service representatives will walk them through the enrollment process through a screen-sharing feature that allows the AHCT representative and consumer to view forms simultaneously.

While most people must wait until Nov. 1 to enroll in plans, enrollment in Medicaid HUSKY and CHIP is open year-round to eligible individuals and families.

The Marketplace

Bans Discrimination For Pre-Existing Conditions: Insurers must cover people with pre-existing conditions and they cannot arbitrarily cancel a policy because an enrollee gets sick.

Free Preventive Care: The law continues to broaden access to free preventive care. New rules regarding testing and medications to reduce the risk of breast cancer went into effect in 2015. Plans must cover (without cost-sharing) risk-reducing medications, such as tamoxifen and raloxifene, prescribed to women with increased risk of breast cancer.

Expanded Coverage For Young Adults: Young adults up to age 26 who do not have access to job-based health insurance can stay on a parent’s plan whether or not they live at home or attend school. The law applies to all health plans, even those that are self-insured.

Annual And Lifetime Dollar Limits: The law ends lifetime and yearly dollar limits on coverage of essential health benefits. That means Connecticut residents with insurance no longer need to worry about going into debt when their coverage runs out.

Essential Benefits: Insurers must provide a minimum level of coverage under 10 categories known as “essential benefits,” including preventive care, emergency services, hospitalizations, outpatient care, maternity services, laboratory services, mental health and substance abuse treatment, pediatric care (including vision and dental), prescription drugs, and rehabilitation and habilitation services. The law applies to all plans sold in the private market or through AHCT—except plans from self-insured employers and grandfathered policies sold before March 23, 2010.

Standardized Benefit Explanations: Health insurers must provide policyholders with standard disclosure forms (no more than four pages) summarizing benefits and coverage, including information about deductibles, copayments, out-of-pocket limits and excluded services. The standard format allows consumers to make informed decisions based on apples-to-apples comparisons of health plans.

Consumer Rebates: Consumers whose private insurance carriers do not spend at least 80 percent of premium dollars on health care and quality improvements can expect to receive a rebate each year.

Prescription Drug Savings For Older Adults: Medicare recipients who reach the prescription coverage gap, known as the “donut hole,” will get a 55 percent discount on brand-name prescription drugs and a 35 percent discount on generic drugs. The donut hole, the point at which people must start paying for their medications, disappears by 2020.

Scrutinizing Premium Increases: Insurance companies seeking premium increase rates of 10 percent or more for plans in the individual market trigger an automatic review by the Connecticut Department of Insurance.

For addresses of Access Health CT’s enrollment centers click here.

Sources: Healthcare.gov, Access Health CT

This report was compiled by Cara Rosner.